Aml Red Flags For Cryptocurrency . We view it as a useful document for vasp to check their procedure against and a step towards clearer regulatory policies for cryptocurrency companies. Red flags of illicit cryptocurrency atms use.

A Roadmap For President Trump S Crypto Crackdown from corpgov.law.harvard.edu By jx · 3 jan 2021. Red flags will always be unique to the business model of each cryptocurrency operation, and will be constantly evolving based on regulatory guidance and criminal activity. We view it as a useful document for vasp to check their procedure against and a step towards clearer regulatory policies for cryptocurrency companies. A summary of money laundering and terrorist financing indiciators highlighted by the fatf. One of the overlooked red flags when evaluating a cryptocurrency is the market size.

The kyc process is generally divided into four. Atms are a reliable method for rapidly transferring cryptoassets , especially for individuals and to discover more about cryptoasset aml red flags and their associated typologies, alongside more information on fraud, compliance, and criminal and threat. One of the overlooked red flags when evaluating a cryptocurrency is the market size. Anti money laundering risk in trade finance banking insurance. Red flags of illicit cryptocurrency atms use. According to the us department of treasury. Kyc/aml using ai can also reduce the amount of false red flags involved in customer screening that stop onboarding unnecessarily by identifying levels of risk correctly.

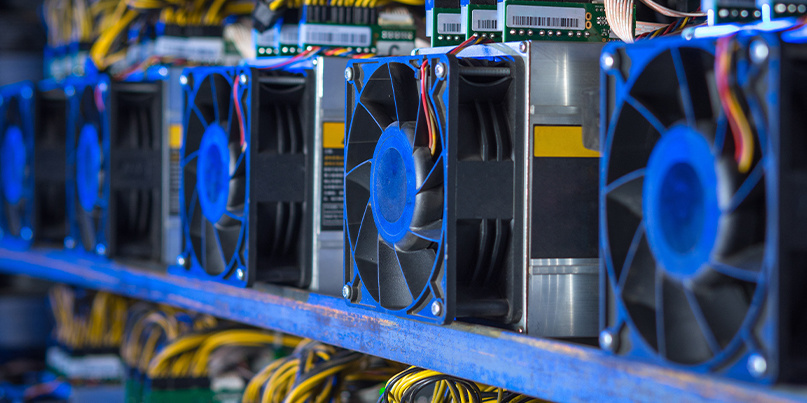

Source: www.scorechain.com Due to the lack of oversight and regulation of regulators in the industry, criminals benefit greatly from this sector's gaps. Bitcoin mining could pose aml threat. Due to the lack of oversight and regulation of regulators in the industry, criminals benefit greatly from this sector's gaps. The kyc process is generally divided into four.

Transferring cryptocurrency immediately to multiple cryptocurrency services, especially to services in another jurisdiction the customer has no relation to, or with weak aml/cft requirements. To prevent the global spread of these activities, regulatory bodies force financial institutions to conduct due diligence on their customers and flag and report suspicious. One of the overlooked red flags when evaluating a cryptocurrency is the market size. As stated earlier, the process of regulatory compliance for aml and cft involves kyc throughout transaction lifecycles.

Transactions that are suspected to be in violation of another country's or jurisdiction's foreign exchange laws and regulations. Transaction monitoring tools like chainalysis kyt are also useful for catching this red flag. While aml regulators have targeted traditional money laundering since the 1930's era of prohibition crime bosses like al capone, current aml operations aim to ensure the confusion between what constitutes aml and kyc is a minefield for financial institutions, often resulting in fines and penalties. Aml red flags as the use of cryptocurrency becomes more widespread, cryptocurrency service providers must deal with a greater range of threats from money launderers that exploit the speed and anonymity associated with the online trade of virtual assets.

Source: www.bitcoinsuisse.com Indeed, part of what makes many cryptocurrencies attractive to. Large numbers of transactions from different customers sent to and from the cvc wallet address each cryptocurrency type presents a different type of risk, but from an aml/kyc perspective, privacy coins pose the highest risk. Bitcoin mining could pose aml threat. Simply put, money launderers will find new ways to structure transactions and hide illicit activity, so red flags need to keep evolving.

Example of red flag indicators in the advisory include: Evaluating red flags can not only save you a lot of money, but also better allocate time to evaluate assets without so many red flags. Large numbers of transactions from different customers sent to and from the cvc wallet address each cryptocurrency type presents a different type of risk, but from an aml/kyc perspective, privacy coins pose the highest risk. Red flags of illicit cryptocurrency atms use.

Trade based money laundering challenges and remendations. Red flag tests is therefore an essential aml technology audit solution for fis to ensure they meet stringent regulatory requirements and that their. One of the overlooked red flags when evaluating a cryptocurrency is the market size. While aml regulators have targeted traditional money laundering since the 1930's era of prohibition crime bosses like al capone, current aml operations aim to ensure the confusion between what constitutes aml and kyc is a minefield for financial institutions, often resulting in fines and penalties.

Source: www.reuters.com Financialish aml red flags went unnoticed. It's also notable considering the constant surplus of aml violations that have. By jx · 3 jan 2021. With a team of professionals from information technology and finance backgrounds, tti.

Large numbers of transactions from different customers sent to and from the cvc wallet address each cryptocurrency type presents a different type of risk, but from an aml/kyc perspective, privacy coins pose the highest risk. A summary of money laundering and terrorist financing indiciators highlighted by the fatf. Aml red flags as the use of cryptocurrency becomes more widespread, cryptocurrency service providers must deal with a greater range of threats from money launderers that exploit the speed and anonymity associated with the online trade of virtual assets. To prevent the global spread of these activities, regulatory bodies force financial institutions to conduct due diligence on their customers and flag and report suspicious.

The following examples are red flags that, when encountered, may warrant additional scrutiny. The following examples are red flags that, when encountered, may warrant additional scrutiny. Red flags will always be unique to the business model of each cryptocurrency operation, and will be constantly evolving based on regulatory guidance and criminal activity. There are a host of coins that are specific in their target market.

Source: pbs.twimg.com Commissions on trades are perhaps the most common monetization strategy for exchanges, cryptocurrency, and stock exchanges alike. According to the us department of treasury. As the use of cryptocurrency becomes more widespread, cryptocurrency service providers must deal with a greater range of threats from money launderers that exploit the speed and anonymity associated with the online trade of virtual assets. One of the overlooked red flags when evaluating a cryptocurrency is the market size.

With a team of professionals from information technology and finance backgrounds, tti. With a team of professionals from information technology and finance backgrounds, tti. The red flag indicators included in this report cryptocurrency service providers should keep in mind that right now a broad target audience is. We view it as a useful document for vasp to check their procedure against and a step towards clearer regulatory policies for cryptocurrency companies.

Red flag tests plays an essential part in the aml compliance programmes of financial institutions as a vital means of mitigating financial crime risks. The kyc process is generally divided into four. One of the overlooked red flags when evaluating a cryptocurrency is the market size. Large numbers of transactions from different customers sent to and from the cvc wallet address each cryptocurrency type presents a different type of risk, but from an aml/kyc perspective, privacy coins pose the highest risk.

Source: assets.website-files.com By jx · 3 jan 2021. Transaction monitoring tools like chainalysis kyt are also useful for catching this red flag. This licencing stipulation was brought into law with the passing of the payment services act (see 'cryptocurrency aml laws in singapore' below) in january 2020. Large numbers of transactions from different customers sent to and from the cvc wallet address each cryptocurrency type presents a different type of risk, but from an aml/kyc perspective, privacy coins pose the highest risk.

To prevent the global spread of these activities, regulatory bodies force financial institutions to conduct due diligence on their customers and flag and report suspicious. It's also notable considering the constant surplus of aml violations that have. Red flag tests is therefore an essential aml technology audit solution for fis to ensure they meet stringent regulatory requirements and that their. Another red flag is when customers transfer cryptocurrency to multiple addresses immediately, especially when these wallets if crypto businesses fail to comply with aml regulations, sanctions may include fines, seizure of business activity, and even criminal liability for senior management.

Example of red flag indicators in the advisory include: Aml red flags as the use of cryptocurrency becomes more widespread, cryptocurrency service providers must deal with a greater range of threats from money launderers that exploit the speed and anonymity associated with the online trade of virtual assets. Red flags of illicit cryptocurrency atms use. Commissions on trades are perhaps the most common monetization strategy for exchanges, cryptocurrency, and stock exchanges alike.

Thank you for reading about Aml Red Flags For Cryptocurrency , I hope this article is useful. For more useful information visit https://collectionwallpaper.com/

Post a Comment for "Aml Red Flags For Cryptocurrency"