An Introduction To Statistical Arbitrage For Cryptocurrencies Part 2 . As one can expect, statistical arbitrage has become a major force at both hedge funds and investment banks, where many proprietary operations. With the present paper, we aim to fill this void.

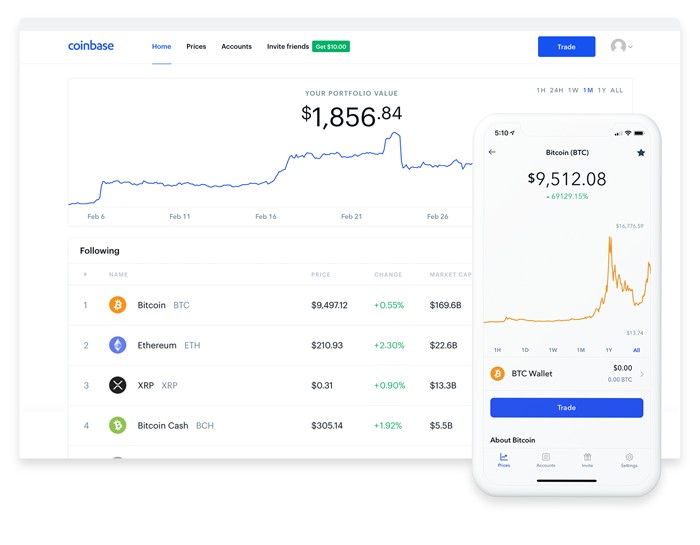

Arbitrage Strategies Part Ii Auto Rebalancing Multitrader Smart Cryptocurrency Arbitrage Trading Platform from www.multitrader.io One of them and the one we will be discussing in this article is cryptocurrency arbitrage. Statistical arbitrage, on the other hand, involves mathematical and statistical models in analyzing opportunities in cryptocurrency arbitrage, such as patterns and differences in price. The theory behind pairs trading is that two companies in the same sector will experience similar market forces, which will. Crypto arbitrage is a direct arbitrage. Crypto trading has been around for quite a few years now;

However, the prices of cryptocurrencies vary from one exchange to another. Thirdly, the statistical or convergence arbitrage. An introduction to cryptocurrency day trading. Crypto arbitrage is a direct arbitrage. With the present paper, we aim to fill this void. Opacity has also increased the need for mathematical maturity on the part of investors seeking to assess managers. Crypto trading has been around for quite a few years now;

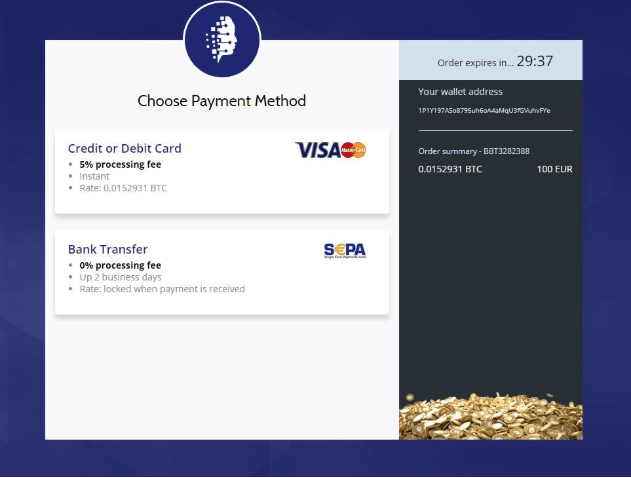

Source: www.multitrader.io I barely knew some of the coins you used as examples so wasn't sure what the volume was like and if they'd. Thirdly, the statistical or convergence arbitrage. It is made possible by the difference between two separate markets having unequal trading volumes. Each crypto exchange has its value for specific cryptocurrencies, and this may be due to.

Cryptocurrency arbitrage is a tough topic. What we do has the risk reducing characteristics of arbitrage but the two hundred or so stocks in each of the two sides of the portfolio, the long side and the short side, are generally not related or. Broadly speaking, statistical arbitrage is any strategy that uses statistical and econometric techniques in order to provide signals for execution. Bitsgap arbitrage is a pure math and the fast execution on exchanges.

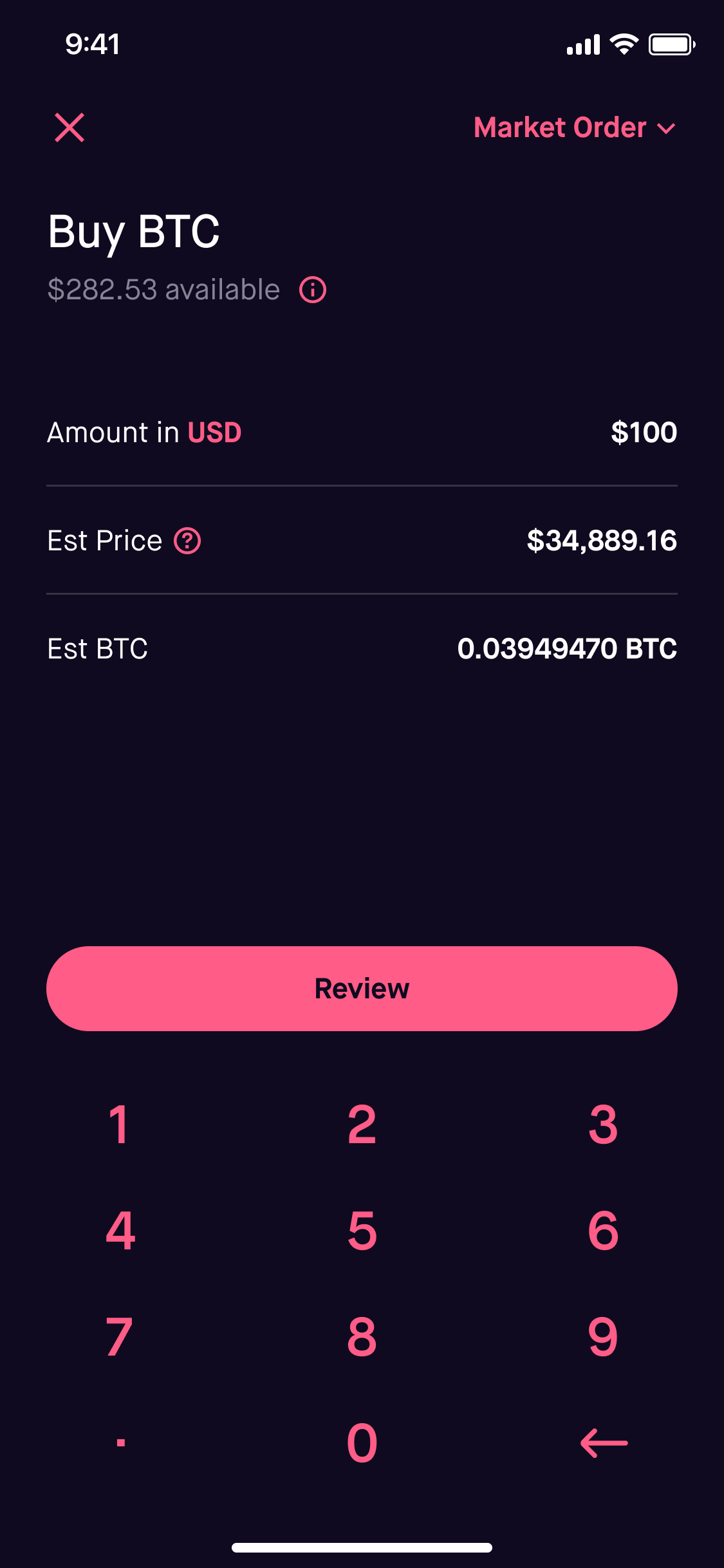

It is the notion that a profit can be made by merely buying and selling the same assets in different markets in order to take advantage of the price difference. When i created this as part of a bank's proprietary group, our strategies were based on arbitrage and volatility levels. Interesting comments and congrats on the bot. One of them and the one we will be discussing in this article is cryptocurrency arbitrage.

Source: www.emerald.com Various forms of pure arbitrage and statistical arbitrage are the basis for almost all quant trading strategies. Statistical arbitrage, on the other hand, involves mathematical and statistical models in analyzing opportunities in cryptocurrency arbitrage, such as patterns and differences in price. The trading strategy referred to as statistical arbitrage is generally regarded as an opaque investment discipline. However, the prices of cryptocurrencies vary from one exchange to another.

Cryptocurrency arbitrage is about leveraging prices to your advantage. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. Cryptocurrency arbitrage is about leveraging prices to your advantage. Statistical arbitrage or stat arb has a history of being a hugely profitable algorithmic trading strategy for many big investment banks and hedge funds.

Opacity has also increased the need for mathematical maturity on the part of investors seeking to assess managers. An introduction to cryptocurrency day trading. Introduction to trading with machine learning on google cloud. Crypto trading has been around for quite a few years now;

Source: bitsgap.com The cryptocurrency markets are a phenomenon. Here is a guide that will help you to understand the principles underlying the system. One of them and the one we will be discussing in this article is cryptocurrency arbitrage. The book is a gentle introduction to statistical arbitrage.

As a cryptocurrency enthusiast and a trader, i wanted to share my analysis in order to determine if arbitrage is only a fluke or a real opportunity to. Interesting comments and congrats on the bot. The theory behind pairs trading is that two companies in the same sector will experience similar market forces, which will. The trading strategy referred to as statistical arbitrage is generally regarded as an opaque investment discipline.

Cryptocurrency arbitrage is a trick which the crypto traders keep up their sleeves to take advantage of the difference in exchange rates. Bitsgap arbitrage is a pure math and the fast execution on exchanges. Crypto arbitrage is a direct arbitrage. Various forms of pure arbitrage and statistical arbitrage are the basis for almost all quant trading strategies.

Source: www.emerald.com As one can expect, statistical arbitrage has become a major force at both hedge funds and investment banks, where many proprietary operations. What we do has the risk reducing characteristics of arbitrage but the two hundred or so stocks in each of the two sides of the portfolio, the long side and the short side, are generally not related or. Statistical arbitrage or stat arb has a history of being a hugely profitable algorithmic trading strategy for many big investment banks and hedge funds. As one can expect, statistical arbitrage has become a major force at both hedge funds and investment banks, where many proprietary operations.

Statistical arbitrage test results シ 10 4 h1 h2 h1 h2 10, statistical arbitrage forex trading how do i use an arbitrage, statistical arbitrage tools for metatrader mt4, statistical arbitrage algorithmic trading global software support an introduction to statistical arbitrage for cryptocurrencies part 1. The authors starts from the basic idea. Crypto trading has been around for quite a few years now; Statistical arbitrage, on the other hand, involves mathematical and statistical models in analyzing opportunities in cryptocurrency arbitrage, such as patterns and differences in price.

Capturing profits and hedging risk with. With the present paper, we aim to fill this void. Crypto trading has been around for quite a few years now; Cryptocurrency arbitrage is merely an extension of arbitrage in more traditional markets and environments.

Source: www.delta.exchange I barely knew some of the coins you used as examples so wasn't sure what the volume was like and if they'd. Statistically sound machine learning for algorithmic trading of financial instruments. This method is more risky than others, since it uses trading algorithms that benefit from price discrepancies that exist for a very short time. Arbitrage trading involves taking advantage of price differences that crop up in financial markets.

In part 2 we will present an actual implementation of these ideas in python, applied to cryptocurrencies. However, the prices of cryptocurrencies vary from one exchange to another. Introductionin this project, we explore quantitative trading strategies applied on cryptocurrency.although cryptocurrency is one of the hottest investment asset at present, most investors still rely on fundamental investing rather than. Statistical arbitrage is a strategy which exploits relative mispricing of closely related stocks based on arbitrage pricing and statistical relationships.

Introductionin this project, we explore quantitative trading strategies applied on cryptocurrency.although cryptocurrency is one of the hottest investment asset at present, most investors still rely on fundamental investing rather than. Take some time and download the cryptocurrency arbitrage tool i created, and see if you can uncover any inefficiencies currently in the market. Statistical arbitrage test results シ 10 4 h1 h2 h1 h2 10, statistical arbitrage forex trading how do i use an arbitrage, statistical arbitrage tools for metatrader mt4, statistical arbitrage algorithmic trading global software support an introduction to statistical arbitrage for cryptocurrencies part 1. This method is more risky than others, since it uses trading algorithms that benefit from price discrepancies that exist for a very short time.

Thank you for reading about An Introduction To Statistical Arbitrage For Cryptocurrencies Part 2 , I hope this article is useful. For more useful information visit https://collectionwallpaper.com/

Post a Comment for "An Introduction To Statistical Arbitrage For Cryptocurrencies Part 2"