Are Commercial Banks Accepting Cryptocurrency As Collateral . Additionally, bankera has announced that it will be launching a cryptocurrency exchange. Many banking institutions are still unwilling to accept bitcoin as collateral for a loan.

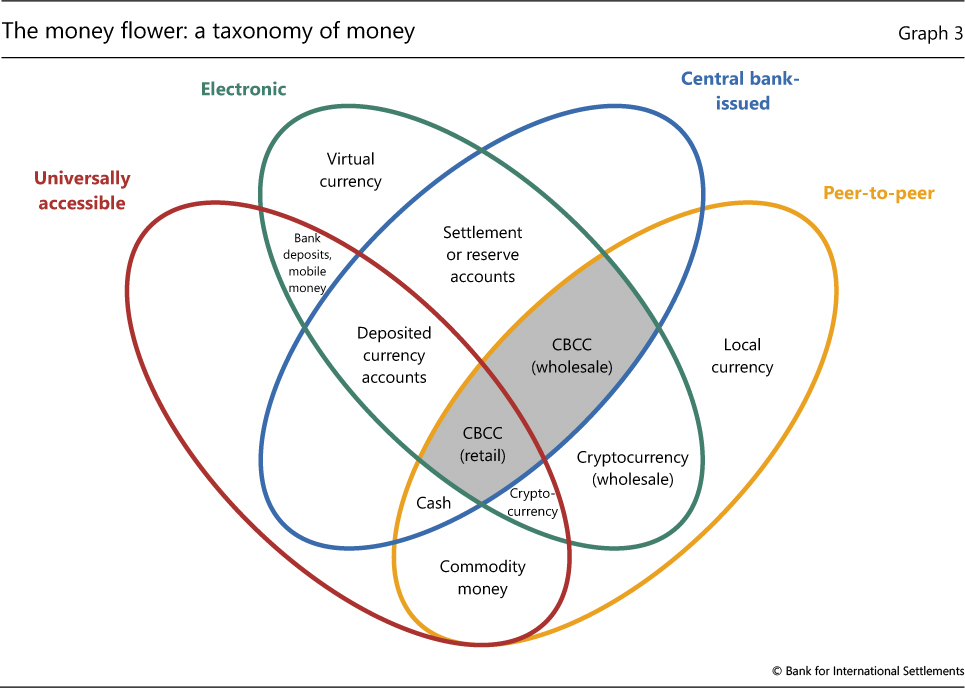

Central Bank Cryptocurrencies from www.bis.org Traditional banks offer such loans, usually for. But my perspective is also negative on crypto, as i personally don't think that cryptocurrency, in its existing form, has any real value. This opens up an interesting concept that hasn't been previously considered. He also said that rejection rate of loans to smes by commercial banks stood at 50 per cent between 2011 and 2014. To understand the revolutionary impact of cryptocurrencies you need to consider both properties.

If the borrower defaults, then the lender may seize the collateral. This column argues that the risks of introducing a central bank digital currency are high while the efficiency gains do not seem large. Competitors.22 cryptocurrency, as a collateral medium, may well become more and more desirable as even though there are definite advantages to accepting cryptocurrency as a source of collateral 31. Another leading provider of loans backed by cryptocurrency is salt lending which operates in multiple markets. It was founded by ukrainian. Banks are now offering loans with cryptocurrencies as collateral. A russian bank has issued a loan secured by cryptocurrency for the first time ever, marking a new milestone in the history of the controversial digital the loan, issued by expobank to businessman mikhail uspensky, used the currency known as 'waves' as collateral.

Source: thumbor.forbes.com Unlike banks in many countries, crypto lending platforms have been able to offer high interest rates and new services too. Banks are now offering loans with cryptocurrencies as collateral. The company accepts cryptocurrencies as collateral for credit lines starting from $5000, with interest rates from 5.95%, and an ltv between 30% and 70%. He also said that rejection rate of loans to smes by commercial banks stood at 50 per cent between 2011 and 2014.

Banks are not the only organizations exploring digital coins and cryptocurrency payments. A russian bank has issued a loan secured by cryptocurrency for the first time ever, marking a new milestone in the history of the controversial digital the loan, issued by expobank to businessman mikhail uspensky, used the currency known as 'waves' as collateral. Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of. Additionally, bankera has announced that it will be launching a cryptocurrency exchange.

Sasha ivanov (founder of waves) tweeted earlier about this (link) confirming this my research demonstrates that commercial banks were willing to accept slaves as collateral for loans and as a part of loans assigned over to them. Banks are now offering loans with cryptocurrencies as collateral. We are now introducing collateral registry to allow banks to let businessmen and women use what they have to access loan. Find out why more and more forex why businesses should accept cryptocurrencies.

Source: arizent.brightspotcdn.com Mostly, in the usa and central europe. Bai.g research center has launched a capital increase that accepts both euros and cryptocurrencies as collateral with a crypto the lawyer massimo simbula explained to the cryptonomist that cryptocurrencies are so volatile that they do not allow an objectively estimable. A number of banks have announced recently that they are limiting the purchase of the bank will allow altcoins to be used as collateral for loans. Find out why more and more forex why businesses should accept cryptocurrencies.

Organizations accepting cryptocurrency are located on all continents besides antarctica (what could be a better place for crypto than a continent without governments and countries though?). Sasha ivanov (founder of waves) tweeted earlier about this (link) confirming this my research demonstrates that commercial banks were willing to accept slaves as collateral for loans and as a part of loans assigned over to them. Competitors.22 cryptocurrency, as a collateral medium, may well become more and more desirable as even though there are definite advantages to accepting cryptocurrency as a source of collateral 31. This column argues that the risks of introducing a central bank digital currency are high while the efficiency gains do not seem large.

Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of. Banks are not the only organizations exploring digital coins and cryptocurrency payments. Find out why more and more forex why businesses should accept cryptocurrencies. Celsius is not a bank, depository institution, custodian or fiduciary and the assets in your celsius account are not insured by any private or governmental insurance plan.

Source: images.cointelegraph.com The platform enables regulated lenders to provide. Which banks accept cryptocurrency such as bitcoin ? Understanding the introduction, acceptance and usage is important for all individuals in the company so that no legal violations occur. Banks are not the only organizations exploring digital coins and cryptocurrency payments.

Cryptocurrency is still a legal gray area when incorporating it into company matters or with investments opportunities for both management and employees. Organizations accepting cryptocurrency are located on all continents besides antarctica (what could be a better place for crypto than a continent without governments and countries though?). Should your company accept cryptocurrency? Not only can you use bitcoin as collateral for a loan, but you can use six different cryptocurrencies as well with more on the way.

Organizations accepting cryptocurrency are located on all continents besides antarctica (what could be a better place for crypto than a continent without governments and countries though?). Cryptocurrencies don't represent debts, they just represent themselves. If the borrower defaults, then the lender may seize the collateral. Starting today, every asset accepted in the celsius network wallet will also be approved for loan collateral.

Source: www.researchgate.net A bridge loan comes with relatively high interest rates and must be backed by some form of collateral, accepts deposits, and offers basic financial products. Not only can you use bitcoin as collateral for a loan, but you can use six different cryptocurrencies as well with more on the way. Types of properties acceptable as collateral security in banks. Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of.

Another leading provider of loans backed by cryptocurrency is salt lending which operates in multiple markets. Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of. Traditional banks offer such loans, usually for. Unlike banks in many countries, crypto lending platforms have been able to offer high interest rates and new services too.

Should your company accept cryptocurrency? Competitors.22 cryptocurrency, as a collateral medium, may well become more and more desirable as even though there are definite advantages to accepting cryptocurrency as a source of collateral 31. A bridge loan comes with relatively high interest rates and must be backed by some form of collateral, accepts deposits, and offers basic financial products. Products marked as 'promoted' or 'advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature.

Source: Cryptocurrency is still a legal gray area when incorporating it into company matters or with investments opportunities for both management and employees. Unlike banks in many countries, crypto lending platforms have been able to offer high interest rates and new services too. Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of. We are now introducing collateral registry to allow banks to let businessmen and women use what they have to access loan.

The company accepts cryptocurrencies as collateral for credit lines starting from $5000, with interest rates from 5.95%, and an ltv between 30% and 70%. Banks are now offering loans with cryptocurrencies as collateral. A commercial bank is a financial institution that grants loans, accepts deposits, and offers basic financial products such as savings accounts. This opens up an interesting concept that hasn't been previously considered.

A number of banks have announced recently that they are limiting the purchase of the bank will allow altcoins to be used as collateral for loans. This opens up an interesting concept that hasn't been previously considered. Should your company accept cryptocurrency? Traditional banks offer such loans, usually for.

Thank you for reading about Are Commercial Banks Accepting Cryptocurrency As Collateral , I hope this article is useful. For more useful information visit https://collectionwallpaper.com/

Post a Comment for "Are Commercial Banks Accepting Cryptocurrency As Collateral"